Rental Home Insurance Coverage Simplified

Insurance is complicated but understandable if broken down into small portions. That’s what we try to do. It’s rental home insurance coverage simplified, really!

RENTAL HOME INSURANCE COVERAGE SIMPLIFIED… REALLY

Let’s be real about the insurance purchasing process for investors. You know you need it or more likely your lender requires it, so you buy it. You work through the process with an agent that asks way too many questions, half of which you’re not sure of (you just bought the property, you don’t know when the roof was replaced, or plumbing and electrical was updated), you muddle through only to get a big stack of papers which you may or may not intend on reading, but is seemingly complicated and convoluted. Look, what I am about to write doesn’t apply to every policy. The best way to know what is insured is to read your policy. This doesn’t replace that, but hopefully, it can demystify things and make your insurance policy understandable.

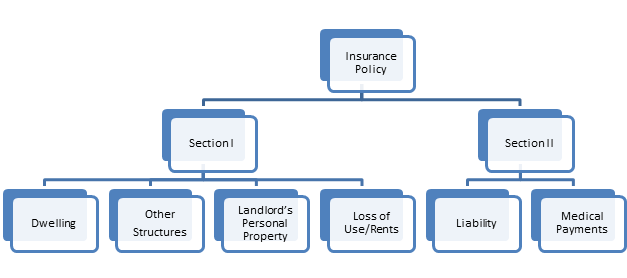

While there are MANY parts to a policy, there are only two sections. Hopefully, we can break it down into understandable bite-sized pieces, and not bore you to death in the process. I hope it’s not too late for some of you. I know some are visual learners, so let me break down a policy visually.

That’s it… kind of… two sections; 6 coverage parts, plus a bunch of extras. For example, there’s the declarations page, the insuring agreement, definitions, perils insured against, exclusions, and conditions… for both sections. Simple right? RIGHT! Baby steps. If you can understand this diagram, you are well on your way to understanding the coverage that you have.

To get an incredible quote these coverage sections start our online quote form. To talk to a licensed agent about this coverage call us at 1-877-784-6787.

This coverage explanation is for illustration purposes only and is general in nature. Coverage explained here may not apply to your policy, State, company, or situation. For more information about how your policy would respond in the event of a loss, please refer to the terms and conditions and declarations page of your policy.