When shopping for home or auto insurance, you have an abundance of choices. You can call the number on TV or shop with a local big-named brand, but then you only get one choice. Independent insurance agents offer insurance from many insurance companies, not one like most others you see on television. The benefits of shopping with a local agent are numerous. Not only will you get to compare pricing, but additional benefits include:

When shopping for home or auto insurance, you have an abundance of choices. You can call the number on TV or shop with a local big-named brand, but then you only get one choice. Independent insurance agents offer insurance from many insurance companies, not one like most others you see on television. The benefits of shopping with a local agent are numerous. Not only will you get to compare pricing, but additional benefits include:

What’s Your Time Worth?

When you call an independent insurance agency, you’re presented with multiple insurance quotes at once from multiple companies. Independent agents will often make a recommendation for protection levels and companies that best fit your needs, but ultimately, the choice is yours.

Professional, unbiased consultations

As an independent agent, we offer clients unbiased advice. After all, we work for you, not a specific insurance company. So, when you get a quote or policy from us, we take care to ensure you’re matched with the carrier with the best options for your specific needs.

Who doesn’t love a discount?

Our agents are discount detectives. We can look at your situation and coverage request and match you with a company that offers you the most discounts along the way. Some of these include safe driver, claims free, home & auto bundles, teen drivers, paid in full, and more! There are so many discounts available.

Local Relationship

As a local agent, we appreciate our connection to the community and being able to speak to our local client base over the phone or in the office. Our agents work and live in your community, so we care about your care and coverage.

Adaptability

This might be the biggest benefit of all. Everyone throughout their lives will need to change their insurance coverage for a reason or another. Perhaps you got married, purchased a home, had a child, invested in a rental property or you want an umbrella policy to increase your coverage. When you work with an independent insurance agency, you don’t have to change agents. We can find you a new company with the coverage and pricing you want for your new lifestyle.

If you need an insurance policy for your auto, home, boat, RV, or even business, call us. We can help you find affordable coverage for your situation. Get a free insurance quote today.

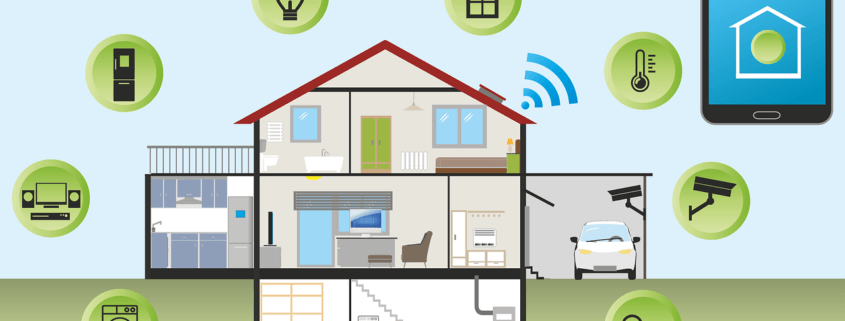

If you’re a homeowner, then you’re aware that it can be complicated to make sure your home is protected. If you’ve ever worried about your home being secure and free from damage, then you should consider purchasing technology that could provide you with peace of mind. Not only do the right devices and sensors provide you with a level of security, but they also can have positive impacts on your homeowners insurance.

If you’re a homeowner, then you’re aware that it can be complicated to make sure your home is protected. If you’ve ever worried about your home being secure and free from damage, then you should consider purchasing technology that could provide you with peace of mind. Not only do the right devices and sensors provide you with a level of security, but they also can have positive impacts on your homeowners insurance.

Taking advantage of technology

The IoT (Internet of Things) market is one that has seen exponential growth within the past couple of years. Within the network of connected devices comes multiple benefits, both for homeowners and insurers. Making sure that your home is protected should be a mutual goal and it’s one that is made easier when your house is equipped with the right technology.

Did you know that there are multiple different types of sensors available to protect your home and help monitor to avert damage? Finding the right sensors could prevent damage to your home, as you can fix the problem before it becomes an even bigger issue. Being able to prevent damage is one of the most valuable benefits that IoT devices and sensors provide, as both homeowners and insurers have a vested interest.

What sensors should you consider?

Which sensors are right for you depends on the level of protection that you want to implement in your home. Many people have devices to protect and alert if a burglary takes place, but there are many other options that you can add as well including smart devices and garage doors.

Water sensors can alert you if there is a leak in your water supply, potentially saving you thousands of dollars in water damage as well as identify a smaller leak before it becomes a big one.

Humidity sensors are similar and can alert you if your house’s integrity is at risk. Implementing smart devices is one of the best ways to take advantage of innovative technology, harnessing its power to protect your home and lower your insurance premiums.

Why purchase additional devices?

One of the biggest reasons why many choose to implement more devices into their home is because of the insurance benefits that they can have. Not only can more technology provide you with peace of mind and assurance, but it could potentially lower your premiums. Because problems can be identified and solved before they multiply, insurance companies also have something to gain when you install the right devices.

Technology also allows for insurance claims to be completed easily. Because technology can be relied on to gain an accurate picture of a home’s state, claims can be settled quicker than normal. Not needing to rely on human assessments streamlines the process and leads to less disputed claims.

Taking the next steps

If you’re ready to learn more about smart insurance and what it could mean for your home, let us know. We’re experts in the field and work with our customers to help them find the right insurance solutions for their individual situations. Make an appointment with us today to learn more about the many benefits of installing devices and sensors in your home.

Make Sure You Are Covered

As a landlord, it’s important that you hold a solid insurance policy for your property or properties. Since your property’s safety and repair relies on you rather than your tenants, it’s important to have plenty of information and a high-quality policy to ensure you are always covered in any situation. Learn about four key factors for landlord insurance today from the team at Gila Insurance Group LLC. Contact us to discover how we can help with all of your insurance needs!

The four main factors of landlord insurance you should know include:

- General liability insurance

- Aspects that impact your policy

- Extra coverages

- What is not covered

General Liability

The first thing that is absolutely necessary as a landlord is general liability coverage. This type of insurance policy will protect you if a tenant or guest injures themselves on your property. Without it, you could be held responsible and could face costly legal battles and fees.

Aspects That Impact Your Policy

In an insurance policy, almost everything about your property will have an impact. However, some of the main factors that may affect the price of your policy will include:

- Your property’s location

- The size of the property

- Pool

- Wood fireplace

- Proximity to a fire hydrant

- And much more

To learn more about the factors that go into considering a policy, you can reach out to our team today.

Extra Coverages To Consider

Each property will have a unique set of needs, which can be reflected in your landlord’s insurance policy. If you live in a high risk flood area, you may be required to have flood insurance. You also might want to have vandalism or burglary insurance options. And in some cases, building codes require certain types of permits or insurance.

What Isn’t Covered?

While many aspects of your property are covered in a landlord’s insurance policy, not everything is covered. Some of the things that are not covered include:

- Tenants’ belongings (they should have renter’s insurance to cover this)

- Maintenance

- Equipment breakdowns (water heater, refrigerator, etc)

Get The Coverage You Need

Make sure you and your property are always fully covered with the help of landlord’s insurance from Gila Insurance Group LLC. Contact our team today to learn more about landlord’s insurance and to get started with your policy.